If You Had a Financial Leak in Your Financial System, And It Was Going to Bust Your Financial Pipes and Bankrupt You, When Would You Want to Know About It?

Financial mistakes are made every day by many business owners without them realizing they cause leaks in their long-term plans until it is too late.

This happened to my family 52 years ago. Because of it, I saw the devastation up close and personal. Obviously, I was so passionate about “financial mistakes,” I authored a book about it, and started a podcast to help business owners avoid making mistakes that resulted in major leaks in their lives.[i]

Many, if not most, business owners totally ignore the red flags which indicate the leaks, but go unattended, which ultimately break the pipes of the financial world of the business owner, leading to a swift exit from their businesses, and or bankruptcy.

Having worked with business owners for many years, I have been up close and personal, to witness some of these financial mistakes.

I am going to list several of them with the hopes they will make you more aware of the red flags when you see them.

Mistakes and Leaks

#1. Depending on your Accountant and your Attorney for your long-term planning.

Business owners assume by having an accountant and/ or a lawyer, they will be up to date on all the tax laws that affect them. False! Most CPAs and accountants provide specialized services and do them well. Accountant’s record history and put out tax fires if your mistake is fixable. Very few are trained in financial planning, or in-depth planning. If they are, they do not usually file tax returns for people, they are in another area of planning.

Attorneys will keep you from doing things that may be illegal or ill-advised and create an unlawful situation in your personal and business life. They are not in the planning business, but normally in the reaction business.

However, you may find an attorney who is proactive in planning, and looks at the whole picture, not only from the documents needed to fulfill your wishes, but also to the financial side of the equation. What good is it to have the greatest documents $10,000 can buy, but there isn’t enough cash in the estate to pay the taxes, or keep the survivors in the lifestyle you wanted them in?

#2. Not getting a certified evaluation of your business periodically. Instead, relying on formulas and fixed price values.

If you think you know the value of your company all you need to do is look at the IRS cases where they have refuted the valuation the estate put on the business in tax court, and you will realize there is more to establishing a value on your company then just general formula. Just because your competitor tells you they can sell their “like kind” business for 10 x earnings, doesn’t mean you can. Every business is different in its makeup and the way it is run. Consequently, so are the valuations. I have been told by my clients;” they are using what the “association” uses for their members”? What? Do not drink the cool aid, use a certified appraiser for your appraisal and save yourself a lot of angst.

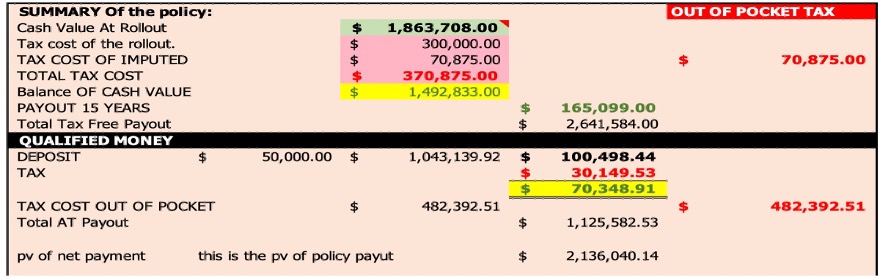

#3. Not taking advantage of your company’s cash flow to create “executive compensation” benefits for you and your family.

By not doing so, you are missing one of the greatest benefits your company can give to you. Your company checkbook can do much more for you and your family than your personal check book, and it is much more tax efficient. You can create a tax-free income for retirement on a fraction of the tax cost of what a pension plan would cost. Also, most of the executive benefits are not regulated by the IRS, giving you much more freedom as to how much you can save, and how long.

#4. Not delegating responsibilities in your company.

By not delegating tasks, you are depressing the future value of your company’s true selling price. Purchasers do not want you; they want a viable key group that knows how to run the business. By not delegating, you do not develop the key group, and potential employees that think like an owner, which is an asset for business’ growth and value.

#5. Not systemizing the business and journalizing the systems.

Having systems in your company, along with documentation creates a much higher purchase price of the business. A purchaser finds greater value by having a ready-made system which drives the running of your business. Systems and documentation must go together.

#6. Not taking the time to plan your estate and incorporate your business planning.

Who gets what, and when? What will it cost to transfer property to your family? What are the things you can do to mitigate the tax bite? Estate taxes are voluntary, and it is only the people who do not plan, who pay large taxes and estate fees. Are the family members ready to run a business? Who will run the business? These are only a few of the many questions business owners should be asking themselves. These are the areas an astute and excellent planner would ask questions about. The type of planning you do, will depend on your family, business, and estate situation. Without this type of planning, great financial pain and disruption in the business and the family can occur.

#7. Not having an up-to-date transition and succession plan.

What will happen to your business when you retire, have a long-term illness, die, or just need to leave? What do you want to happen to it? Without a thought-out plan, there is a financial mistake and a financial leak. Since your business may make up most of your wealth, without a succession plan, you jeopardize the future value of the business along with the future financial security of the family and your loved ones.

#8. Not having records of your business and your estate organized for your family should you die.

You are not around, what did you want to happen to the estate and the business? Without instructions, the estate is lost as to what you wanted to happen to your business. Without instructions they do not have the permission to continue the business, pay certain bills, keep employees. At the very least, this is an area which you should have communication with your family, and documentation of instructions.

#9. Not having a “Plan B transition,” when you have not completed a Plan A.

So many business owners talk about having a plan of transition and succession, but never get around to getting it done. In this case you are better off having some plan, rather than not having any plan. This is the Plan B: “The JUST IN CASE PLAN.” This is the plan that comes into effect if you were killed in a car accident on the way home from a party, but you did not have any formal plan, because all the unsigned papers were in your top drawer in your office, for the last three years, PLAN. GET my drift?

#10. Having most of your sales come from only a few clients.

Happens more than you can imagine, and you need to be aware of it. If this is the case, start acquiring more clients. The reasons are obvious. If you have more than 10% of your sales coming from one area, you should start acquiring more clients. What happens if that customer finds a better provider with lower prices? What happens if they are aware that you are dependent on their business? Again, it is obvious that this can be a problem if not changed.

#11. Your professional advisors should be working as a team with each other for your benefit.

In my book I discuss one of the best tools I used in planning for the business owners, which was having a periodic meeting with the other advisors to keep them in the loop. The benefit was to learn what they were doing for the owner, and to communicate to them, what I was doing. It helped to avoid overlapping. Also, I found that some of the members knew more about the owner’s likes and dislikes, which helped us understand their thinking, allowing the team to produce solutions that made sense and were workable. Ask yourself, how many times have all your professional advisors sat down in a room together to discuss your challenges and your dreams?

#12. Not sharing you planning with your spouse.

It certainly makes it much easier when both spouses are on the same financial page. One of you will be the end user of your estate assets and it would be best for all parties to know what the long-range thinking is. Have a spousal business discussion periodically. It really helps.

#13. Having the wrong type of business structure currently in your business career.

Many times, the business structure you started with, is not the structure you should have currently. Over time, the business grows and outgrows the same business structure you started with. It could be another type of structure would be more effective for your current financial situation. I see many companies who should be an S corporation now, but have stayed in the original structure, only to pay more payroll taxes than they need too. The type of business structure you will use, is driven by tax planning and protection. It pays to discuss this aspect of your business as it may provide better protection and save taxes. Your accountant can guide you.

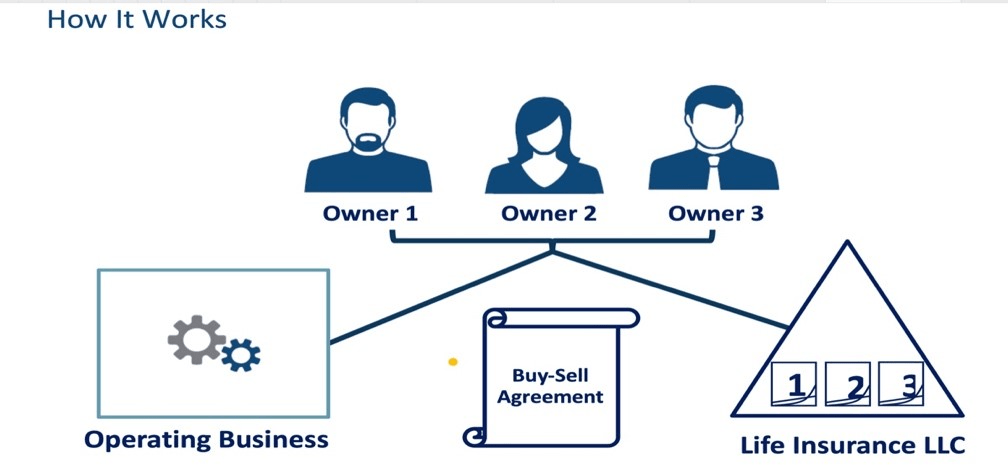

#14. Not having a Buy and Sell Agreement/Business succession agreement. What is going to happen to the business at your death, or one of the seven triggers.

You have a Buy and Sell Agreement (BSA); however, the agreement doesn’t discuss the funding of a triggering event. For example, if a partner died, life insurance would be the best choice to fund this triggering event because it would be the least expensive. However, other triggers, such as divorce, termination, bankruptcy, do not have vehicles to fund the event. The BSA must address how they will be funded? Many BSA do not address the funding of a particular trigger. Will there be a loan, a note, cash flow? It is best to discuss these areas while all the parties are living and involved. Keep in mind, that the BSA is a contract, and the parties of the agreement are liable for the payments to be made.

#15. Not taking advantage of the income tax laws which allow you to spread some of the benefits to lower taxpayers in your family.

Have your kids work for you and earn a salary? That salary will be at a lower cost and could be part of the funding for their college. Or changing your business structure to save taxes. As an example, becoming a S-Corp and taking a lower salary to avoid payroll taxes. There are many areas of the income tax law that favor family participation where there is a shifting of tax obligations. Your accountant would be a great resource to discuss this with.

#16. Not taking adequate time away from your business.

In my book (Unlocking Your Business DNA), I wrote about taking much more time off from your business. There are so many reasons to consider this. For example, I worked 80 days a year seeing clients. The other days, I worked on the business, but did not see clients, and this gave me more time freedom. This allows for more creative thinking, less stress, better family and employee relationships, and a host of other benefits. Many business owners can design this type of arrangement when they consider delegating and implementing systems in their business. This is also important for at least two reasons: 1-Employees can learn how to think like owners. 2- By taking time off you start to create great ideas for the growth of your business and help enhance your qualify of life. I call this the ideal business and personal lifestyle.

One minute Survey assessment tool get your free Business Assessment using the One-Minute Assessment Tool. This tool will help you uncover potential mistakes and financial leaks you don’t even exists. When you don’t know they may exist, you don’t have the choices of resolving them, or ignoring them like other KNOW MISTAKES. This tool will do three things:

- Make you aware of your current planning to this point good or bad!

- Make you aware of the financial mistakes planning we do.

- Help you formulate questions you may want to discuss

CLICK HERE. For your One-Minute Survey

[i]“Unlocking Your Business DNA”, Thomas J. Perrone, CLU, CIC – AMAZON