But you do need this…

Dear Fellow Entrepreneur, who wishes to grow their business and enjoy what they are building…

did you ever wonder why some business owners run a successful business while others claw up a mountain to stay in business? It comes down to one STRATEGY, in my opinion.

A Recent Survey Reveals That 86% of Small Business Owners Risk Bankruptcy or A Forced Exit by Missing This Strategy!

Only 14% Of Business Owners Will Enjoy the Value of Their Business! i

You and I are entrepreneurs, wired with passion to run our businesses. I want to share with you a powerful strategy that will change how you run and grow your business. It will give you more clarity and create more simplicity in your life. This powerful strategy is one of the major contributing factors to building value in your business.

Have you ever noticed how some business owners keep more of the money they earn, work less, have unlimited family time, avoid getting drained by taxes, keep the best employees, and run their businesses, not the other way around?

My clients tell me the strategy has given them clarity and has simplified their lives allowing them to enjoy more of what life offers!

THE ISSUE and THE PROBLEM: The mindset when you start or buy a business is to bring your product or service to market quickly to create cash flow. This is the “action planning”, and it’s all about cash flow. The problem is you stay focused on the ACTION PLANNING MODE and neglect the DETAIL PLANNING MODE altogether, creating financial chaos, and diminishing the chances of accomplishing your dreams and aspirations!

Enter the Business Growth, Wealth, and Transition Plan (GWT PLAN) which focuses on the details of the Growth, Protection, Equity creation and Transition of your business. The GWT PLAN is a “Designed Plan” and creates the future financial success of your business. The GWT PLAN is like Kryptonite, fighting off bad mistakes, lost opportunities and keeping you on the path of building your business’ future wealth!

A TRUE STORY: In 1971 my father died suddenly at age 51. His very profitable business in Hamden, CT, was sold for pennies on the dollar. My mother went from middle class to poverty level overnight. She was forced to sell the family home and move to a few different neighborhoods, giving up what she loved the most, which was cooking for the neighborhood kids. This created great emotional turmoil in the family.

THIS DID NOT HAVE HAPPEN, BUT IT DID. Why? Because my father had a “Default Plan”, NOT a “Designed Plan”. He winged it, like so many business owners do. Because of that, he lost his “Life’s Effort”, and his legacy, at an extreme cost to his family.

If You Had a Financial Leak in Your Business That Was Going to Burst Your Financial Pipes, When Would You Want to Know About It?

YOUR SCENARIO WITHOUT A GWT PLAN

If you died or became disabled today, what will happen to your business? Without a plan, the banker would call your credit line, the vendors would stop selling to you, your key people would be looking for new jobs along with other employees. Your family would need to get permission from the probate court to run the business without breaking the law.

If your Key Person told you they were leaving along with five other employees, what would you do about this? The banker will call the loan, your vendors will cease to give you credit, you may lose other employees, and you would lose income very quickly!

What if you were in a squeeze economically, business was bad, costs were high, gross revenue is not covering expenses, what do you do? Call in Mr. Banker, and hope he has confidence in your business to solve the problem (remember Covid) and hope for credit!

You had enough; you want out. What’s the value of your business you want to sell? 86% of your fellow entrepreneurs are not going to sell their business, what would make you any different?

The Same Scenario HOWEVER, You Implement Your GWT Plan!

#1: Your banker doesn’t call your equity-line and they are satisfied with your continuation plan. Your family has planned instructions on how to run the business, while your employees are satisfied and confident of the continued success of your business.

#2. Your key people stay on because you have incentives for them to stay. Also, you have protection documents that would thwart their ability to compete with your business if they left.

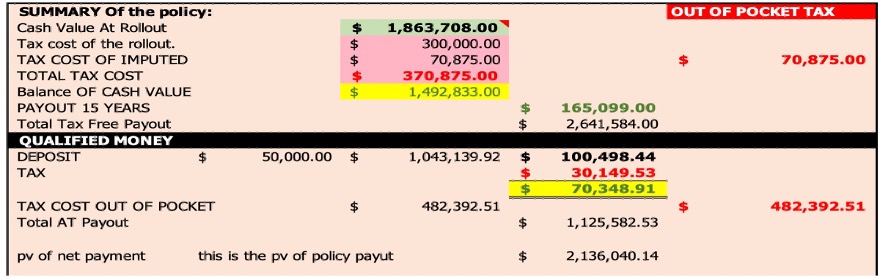

#3. If you were so unlucky to hit a bad economic turndown, you have a special benefit in place to fund your cash flow without having to beg for money from the bank. This was created through your business cash flow in advance. It is substantial in value, and tax-effective, creating personal wealth outside of your business.

#4. You have been systematically formulating plans over the years for the purpose of transition someday. Because of that planning, purchasers are interested in buying your business at the highest potential value.

If You Are Investing Money, Time, Pride, Sweat and Nerves in Your “Biggest Effort in Life”

Why Would You Not Spend the Time to Protect It From the “What IF’S By Implementing Your GWT Plan!

It’s Not Your Fault However! It’s the Planning Professionals Fault!

Here is the difference between planners and what we do and why we make a difference…

It’s their agenda, not yours. –

The GWT PLAN agenda is designed by you. You pick the subjects you wish to plan for.

No respect for your brevity-take too long to plan.

The GWT Plan uses educational tools such as short videos, so you learn on your own time and verification of what you learn via conference calls.

They charge too much and complicate the planning making it more complex than necessary.

The GWT Plan charges are a fraction of the market charges for planning and is designed to be communicative and simple. We use a patented plan called, “The One Page Solution”, which describes the issue and the solution on one page, and this is done, one issue at a time.

They are averse to working with your other advisors.

The GWT plan encourages your other planning team to join us, so we have all the information about your dreams and aspirations and what your team has been doing for you. We welcome all professionals to engage in your best interests.

Many planners have never run a business or walked in your shoes.

We have been in business for over 50 years and have never been in any other business professionally, and know what it is all about having staff, payroll, working with banks and having an array of tasks to deal with.

They don’t spend time learning about your business and your value system, and don’t listen well.

The GWT plan doesn’t start planning until we feel we understand what your dreams and aspirations are. By using our tools, we not only learn about what the facts are, we learn about how you feel about what you are trying to accomplish.

Despite this…To Survive and Thrive in the Future Economy YOU NEED A GWT PLAN TO…

Create a path to follow for success with clarity and simplicity for your business and personal life to help you enjoy your life.

Create a business culture to help hire the right employees, develop middle management for your future transition, and free up more time for you.

Uncover opportunities in creating wealth in your business with tax efficiency through your cash flow while protecting and growing your financial future.

Develop a solid transition plan to maximize the value of your business for your future financial security while creating wealth outside your business!

Learn the secrets of developing your GWT Business Plan by requesting my FREE E-BOOK. I am offering a limited amount of copies for distribution over the next fee days! Take control of your future and go down the path the will give you CLARITY AND SIMPLICITY ALONG WITH GREAT SUCCESS!

REQUEST YOUR FREE COPY of my published book, “Unlocking Your Business DNA”, and learn the benefits of having a GWT PLAN! ORDER NOW- distributing a limited number of E-Books.

Click Here to get your Free DOWNLOAD E-BOOK